Artificial Intelligence: the capability of a machine to imitate intelligent human behaviour

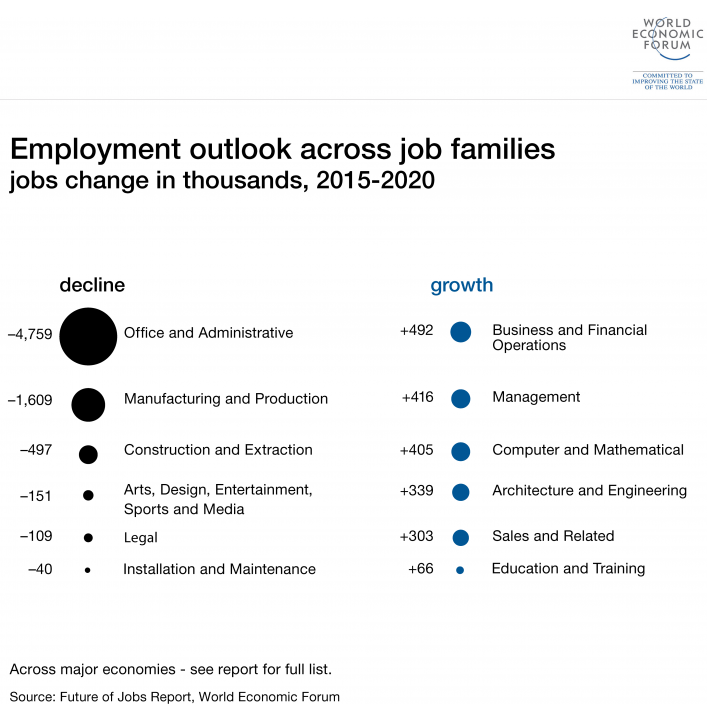

In case you have not noticed, the workforce is changing at a rapid rate and AI is a key driver in this change. For a comprehensive picture the ‘World Economic Forum – Future of Jobs’ report is a good starting point with an expectation of a net reduction of 5.1 million jobs across 15 advanced economies by 2020, the majority white collar albeit more administrative in nature.

And what about the Google prediction that by 2029 robots will achieve human intelligence levels, and that by 2025, 33 per cent of all occupations will be performed by robots.

To give that some context, my oldest child will only be entering the workforce and a robot will be her workforce peer at least on an intelligence measure.

But what does this mean for you? If you are reading this blog you’re likely to be an Accountant or Finance professional in Australia in a relatively senior role. My take is that it’s an opportunity. The process-focused finance model is dying – which is not a loss if you ask me. Accenture analysis shows that by 2020, cross-functional integrated teams will deliver 80% of traditional finance services. Finance-staff productivity will increase by two to three times. As a bonus, the finance organisation’s costs will decline by 40%. It will affect functions at many levels and even the role of the CFO will change.

The evolution is coming. Take stock and take action now, don’t become tomorrow’s dinosaur!

Where do you start?

- Managing a large team with repetitive processes? Use (OCR) technology to reduce manual tasks.

- Working in FP&A? Leverage self-service reporting tools or shared service teams to create standard management reporting packages, then use FP&A teams to add insights.

- Responsible for statutory reporting? Use technology to leverage existing data sources and baselines to help reduce the manual work of extracting, manipulating, and reconciling actual data from source systems.

- Currently using complex archaic legacy systems? Review your current ERP system, cloud-based platforms will become predominant with Accenture research revealing that 85% of CFOs say they plan to increase their investment in the cloud.

In my mind where you will go wrong is if you decide not to embrace change. I only need to look at my own backyard in recruitment, at the start of my career we had just stopped sending CV’s via Fax and it was only 10 years ago that we acknowledged print advertising was not vital to a senior recruitment process. LinkedIn has been around for a while but industry saturation is only relatively recent. Today I am actively encouraging our business to be at the forefront of technological innovation, yes it’s expensive but the risk of not investing is too high.

Do your research and encourage your business to invest in the future and go with them on the journey. If you do this you will not become a World economic forums jobs statistic, you will be an employee of choice for the accounting industry of 2027, whatever that might be.

Are you ready to embrace change and future-proof your career?

If you would like to keep up to date with latest innovations and changes in order to understand how they will impact your career and transform your workplace register for our Transformation and Change Management forums

We would love to hear your thoughts. Feel free to comment on our LinkedIn, Facebook, Twitter or register to receive monthly via email.